In this post I intend to focus on real asset prices versus nominal prices, as well as the cyclical movements of those prices.

Real prices deal with price changes over a period of time after factoring in inflation. Nominal prices deal with the numbers only without adjustment for inflation.

There are cycles in the prices of all assets. The professionals tend to buy undervalued assets and sell when they are overvalued. The amateurs do the opposite. There are far fewer pros than amateurs in every asset market, and the pros engage in asset rotation, never sticking with just one thing, constantly moving their money from high-priced assets to low-priced ones. The pros also short assets (bet on over-priced assets falling in price) so they make money in both rising and falling markets.

There are many images in this post. Click on any image to get a sharper view.

Typical Investment Cycle

Below is a chart of a typical investment cycle. What is important is that there is usually a

long, flat bottom when assets are undervalued and the "smart money" accumulates. Then there is a

gradual run-up in price as buying pressure increases. Following the gradual rise there is often a

parabolic "blow-off" where prices ramp up rapidly and the asset becomes quite over-valued (although the public buying at this point will dispute the over-valuation). Finally there is the

price collapse where the public is encouraged to buy more because the asset "is so much cheaper". You're not at the bottom until you hear all your friends and neighbours state, "I'll never buy asset X again!" (But that doesn't stop them from buying overpriced asset Y the next week.) At this point asset X probably has

dropped below the long term price trend line, and is under-valued. This chart is from

Jean-Paul Rodrigue.

Here's another showing the same general cycle, but more from a trader's point of view.

Stock Market Cycles

Below is a long term chart of the Dow Jones Industrial Average showing both nominal and real prices, ignoring dividends. "Investment advisors" flogging stocks usually talk about the nominal numbers (blue price line), to exaggerate returns. Knowledgeable investors always look at real returns after inflation (pale green price line).

In the above chart I have added three horizontal lines. The green one shows that if you had bought the DJIA at the height of the "roaring 20s" it would have taken you to about 1960 to break even in real prices. The mauve one shows that if you had bought the high of 1966 it would have taken to about 1996 to break even (my manual calculations in the past showed the break even in 1998). And the aqua line shows how the 2007 high is at about the same level as the 2000 high in real prices.

Note how the DJIA tried to break above 1000 several times (nominal prices) from 1966, until it finally made it in 1982. Of course the DJIA at 1000 in 1982 only had 28% (my calculations) of the purchasing power that it had in 1966, so that's why you have to go way up the curve in nominal prices to 1998 to get break even in real terms.

During all of these periods the pros made huge fortunes trading the cycles up and down, while the "buy and holders" on average had meagre returns, since they tended to buy most near the tops of these cycles, and got fooled thinking they were creating wealth simply because the nominal price may have gone up.

Commodities

It is important to understand commodity price trends because the price of commodities feeds into most of the goods that we purchase. While commodity prices have been in a general decline for a century (see image immediately below), I think this "gravy train" has come to an end due to large world demand increases. In specific, I think energy costs will drive the real cost of most commodities up (see my post "

It's all about Energy"), in turn causing a lowering of lifestyle in the developed nations.

Crude Oil.

Note the long period of stable, low prices prior to 1973 when much of the North American growth took place; also note how the top of the 1979 price spike wasn't that much smaller than the 2008 one in real terms. In 1980-1982 we suffered a double dip recession with high unemployment (sound familiar?) The 1990s was also a period of economic growth with low, relatively stable oil prices. Oil was at $30/bbl in 2003 before the looting of Iraq began. Don't hold your breath waiting for it to return to $30.

Gasoline

Canadians live to complain about two things -- the weather and gasoline prices. After all, we all know that gasoline prices are unrealistically high and the oil companies are gouging us. (I don't know that, but most Canadians seem to; I am of the belief that gasoline is one of the greatest bargains ever.) In the chart below note how the real price (2010 US prices) during the Great Depression, during the 1980-82 double dip recession, and the 2008 run-up all had annual average prices over $3 per gallon. Also note the all time cheapest real prices during the 1990s. The long term chart indicates that prices should work their way down below $1.50 (2010 dollars) in 3 to 4 years. Any bets? It can get there, but we'd be in the "Greater Depression", which is always a possibility.

Gold

The real price trend in red in the below chart indicates turning points in long term asset trends. We had a hard asset cycle for several years before 1981 when commodities tend to do well and financial assets like stocks and bonds are less profitable. From 1981 to 2001 financial assets did very well, in a disinflationary declining interest rate environment, and commodities were generally not great investments. For the last decade, and perhaps for most of the next one we will be in a hard asset cycle again, and stocks will perform poorly.

It is possible, maybe even probable that there will be a parabolic price lift in the price of gold towards the end of this hard asset cycle, like the run-up in 1980. Many Canadian estates being settled now have gold coins, sometimes bullion as part of the estate. Many of those deceased persons bought near the top in 1980 and the real price of gold today in the $1200 range is likely still below their purchase price.

In 1982 when I was working at a financial institution my manager came in one day with a hockey bag of gold bullion that he was selling. Apparently he had accumulated the gold during the 1970s and thought (correctly) that the inflationary cycle was over and there was little potential for further price run-up. The bag was very heavy, so it probably held about $1 million in gold in today's prices.

Bonds

As interest rates drop bond prices go up. Note the highest rate of the 30 Year Treasurys was in 1981, at the end of the previous hard asset cycle, and we are currently at very low rates (closed at 3.72% today). This abnormally low rate is an indicator of economic desperation, not strength. However, the fall from 1981, in general, resulted in economic growth.

I recall selling a $500,000 5-year income averaging annuity to a client in 1982, yielding 18% interest. He had just sold some land in Alberta (not bad timing, but 1977-78 would have been better) and was looking for more profitable allocation of his funds.

Copper

This commodity is often referred to as "Dr. Copper" because it appears to have a Ph.D. in economics, as its price movement tends to indicate the direction of the economy. I don't rate most economists as highly as copper in matters of intelligence, and copper also has the added advantage of being useful to mankind. Note how the real price of copper reached all time lows in real terms during the 2001-2003 period.

Corn

Corn is one of the most important agricultural crops, with other grains and soybeans generally moving in the same direction as corn. Note in the below chart how the real price of corn dropped due to cheap energy and improvements in yield until recent years. I attribute the recent real price rise to the corn ethanol industry. So now corn trades partially as an agricultural product, and partially as an energy source (and a damn poor one at that). Just another irrational farm subsidy, sold to a gullible public as the means to energy independence.

Housing

This section will have the most charts and discussion because it is the most important asset for most people. This is where North Americans have ("used to have" in the United Spendthrifts of America) most of their wealth. Some people are very emotional about housing. Telling them that a primary residence is not, never has been, and never will be a great investment is like telling a Christian fundamentalist that the world is over 6,000 years old. (That doesn't mean it can't be a good investment under the right circumstances, when done by knowledgeable people seeking rental income, or as a personal dwelling when bought near cycle bottoms.)

There was a time when buying a house was a very important decision. People saved for several years for a substantial down payment of 20-25%, and then worked hard to pay off the mortgage in 20 years or less. A house was a place to live, not an investment. A married couple who bought a house often raised their children there, and retired there, never seeing a need to change (not many realtor fees in that lifestyle choice).

Following the stock market drop in the early 2000s I heard many people say they'll never invest in the stock market again (asset X), but will put their money into something safe that never goes down like real estate (asset Y). While I laughed at the time, I had no clue how over-valued housing would get, fuelled by low interest rates and minimal or zero down payments. And of course the

governments,

banks, home builders, and (

my all time favourite housing clip) realtors attempted to push anyone who could fog a mirror into purchasing.

The combined effect was to push the home "ownership" rate up from 64-65% to 69%, as in the chart below. The same thing happened in Canada. Many of those new "owners" were not financially in a position to take on a mortgage, and will return to renting, taking down others as well. The "ownership" rate might even drop below 64% as the public finally learns that a house and a retirement plan are two different things.

There was a

study done on Amsterdam house prices covering 1628 to 1973 that showed houses there appreciated about 0.2% per year above the rate of inflation. (That should be good enough for those who say as long as you buy for the long term you will make significant gains in housing.) 0.2% above the rate of inflation is not a desirable investment return.

Robert Shiller referred to the Amsterdam study when he did his historical analysis of American house prices as shown in the chart below. Shiller found a long term price appreciation of 0.4% above the rate of inflation in the USA. Note the relatively stable real price of housing from about 1950 to 2000, with prices contained between the 105 and 125 levels.

Here's another chart showing essentially the same information, except it also has nominal prices (blue line).

Below is a chart showing housing prices in the USA, Australia and Japan, with all prices normalized in 1980. Remember the 1980s when everyone thought Japan was an unstoppable industrialized nation who would soon own much of the property in America; people were learning Japanese, as you recall, to prepare for the future. After 1990 the Japanese economy went into deflation. Since then housing prices have moved down due to extreme over-pricing in the 1980s and a banking system that refused to acknowledge its loses. (Sound familiar? Show that chart to your realtor buddy who insists prices always go up in the long run. In the long run we're all dead.)

Australia is way beyond stupid-high prices, due to three government interventions to blow the housing bubble higher. Prices are just levelling off, and there will be much pain for the middle class in future years. The prices in America are getting closer to the long term trend line. However, America being an empire in decline, I expect prices to overshoot considerably to the downside.

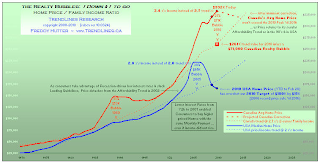

Below is a comparative chart of US and Canadian house prices, with a normalized starting point of 2000. Note that US home prices and Canadian prices both doubled 2000 prices, but it took Canadian prices four years longer to get there. After the prices started to drop in 2008 Harper and Flaherty issued a gazillion hand mirrors to employees at the banks and CMHC. The directive was something like, "Anyone who can fog this gets a mortgage, capice?" Then they went on a disinformation campaign telling the entire world how prudent Canadian borrowers and lenders are. Any guesses what happens next to Canadian prices?

Let's examine house prices in boom-and-bust Alberta, the only province in Canada to have been officially bankrupt. The next chart is from the

Edmonton Housing Bust blog where there are several good charts and some decent housing price analyses. The

article that this chart comes from is very good, and worth a study. Note that if you bought in 1977-82 it took you 24-29 years to break even in about 2006 (see mauve line I added). Chart values are in 2009 dollars. Note also the author arbitrarily applied a 1.8% growth rate above the real house prices to establish the green trend line; house prices are about $100,000 above this trend line. But of course "it's different here -- we have oil". So does Texas where house prices are much cheaper. Heh!

Next is a chart of Calgary prices where "

radley77" did a similar exercise, and fitted a 1.2% trend line to the real house prices. I added the mauve line to show it took until 2004 to return to 1977-82 real prices. Note that extrapolation of the 1.2% growth line shows recent prices to be at least $100,000 above the long term trend. It seems just like yesterday that Calgarians were defaulting on their mortgages in droves, but it probably was during the 1980s. You could buy houses in Alberta for $1 then; the catch was that you had to assume the existing mortgage, which many people ultimately found to be a very bad deal. But "it's different this time!" Heh!

For a different comparison, here's a chart showing Calgary house prices plotted against per capita GDP. Note how house prices jumped away from per capita GDP in 2006, leading to a gap of about $100,000 in 2007. Any guesses on how the gap between the two will be closed?

Alberta has had a bit of a price pullback, so Edmonton and Calgary are not as over-valued as Toronto. And then there's Vancouver. What can I say, except it is rated as having the most unaffordable housing in the world.

Jobs, Debt

Does anyone other than me see a trend in the labour participation rate of males in the USA? Gee, what could this mean for the economy and purchasing power of the population?

As interest rates drop, so do savings rates. When they can't get a decent interest rate on money on deposit, people tend not to save, but invest in risk assets and borrow more. The below chart shows the drop in savings rate in the USA, which matches up nicely with the 30 year Treasury rate posted above.

Next is the savings rate for Canada plotted against interest rates. Do you think banksters might know exactly what they're doing here? The looting of the middle class continues. It won't be pretty when interest rates turn up. Expect massive debt defaults.

Canadians have the highest ratio of debt to income (144%) of the 20 OECD countries, as described in this

recent article (May, 2010) and illustrated in the below chart from that article. After we default on our debts, as many Americans have done, we should once again look more prudent than our American friends and relatives.

The Economist Magazine recently

published an article that pegs Canada's housing market at 23% over-valued on a price/rent ratio. Australia wins the prize at 61%.

I have previously posted on some real estate transactions that I thought were ill-advised, showing how little Canadians know about housing valuations. Just when I thought we must surely be out of greater fools, I find there are more.

This article mentions how the Ottawa market is booming, due in part to university students buying condos. You can't make this stuff up.

A 22 year-old student has bought a condo under construction, available next spring. Which just proves her tuition was a total waste of money because she clearly has no critical thought process. She probably dropped "Inadvisability of Buying Pig in a Poke 101" for "Twitter 303". And her friends are looking for condos also. I fear for the future of our country.

Our American friends must be shaking their heads knowingly. Sort of like watching a teen horror movie. "No. Don't go into the attic. Nothing good will come of it! Haven't you ever seen this scenario before?"

Apparently not.