In that post I outlined my reasons for believing that an average price of oil of $85 per barrel over a 10 week period (50 trading days) would be enough to send the American economy into recession. Well, we're there, boys and girls. In the chart from stockcharts.com below you will see the 50 day moving average (blue line) closed at $86.06 today. Click on graphic for sharper image.

But could I be wrong? All the news out of Fraud Central (aka USA) states that things are much better, and the markets are going up.

Of course I could be wrong, but hopefully never so much as a central banker like Alan Greenspan or Ben Bernanke who repeatedly failed to identify economic problems they had created, as in this clip.

In May of this year we had a stock market pullback accompanied by a pullback in commodities prices. My 50 dma oil price peaked at about $83. In August Bernanke stated at the Jackson Hole summit that he would do whatever it took to support the economy, which was not performing as well as he had previously predicted. This was widely interpreted as a promise to inject more liquidity into the financial sector, and the Banksters were off to the races once more.

In November he announced his plan to inject $600 billion of "quantitative easing", between November and June, 2011. And he would top that up with about $300 billion more from mortgage-backed securities held by the Federal Reserve as they matured. The end result is a plan to inject about $7.5 billion per day into the economy, which he interpets as the Wall Street Banksters.

And about a week before Christmas President O'Bomber announced a deal he had made with the Republithugs to extend "temporary" low tax rates for another two years, accompanied by an extension of unemployment benefits, and a few other tax reductions for a total of about $858 cost to the taxpayers over two years.

Now, out in the real world where central bankers and Washington politicians spend little time, people around the world didn't like these plans. It looks like the United Subsidies of America is happily continuing down a debt spiral to oblivion.

The people I call the commodity vigilantes bid up most things that had real value. Oil, corn (and other grains), copper, cotton, gasoline and others have been going up. Copper recently set a new all time high.

My take is this. Anything that is widely needed will be bid up in price, things like food and energy which are the first to increase in price in an inflationary cycle. But things that are not needed will go down in price, like electronics and housing. Earnings are not going up in real terms for the lower economic classes, while they are for the top few percent. In fact, the largest private employer in America, Wal-Mart is removing its $1.00 per hour Sunday premium for new employees. Why? Because it can. I use Wal-Mart as an example of overall wage suppression.

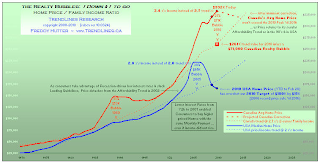

But surely housing is a need? Nope. Shelter is a need. Housing is a lifestyle choice. Most of the housing space in North America is not a need -- it is a luxury, so it will continue down in price in the US, and begin the descent in Canada in 2011.

Two things have backfired on Bernanke so far. Commodity prices have risen. This results in one or both of two consequences:

- Higher prices of consumer goods if the price is passed on; or,

- Lower profits for businesses if the cost is not passed on.

The second thing that backfired recently is that long bond rates have risen, the opposite of Bernanke's intention. American 30-year mortgage rates tend to follow the long bond rates. In the chart below divide the rate by 10 (44.30 is 4.43%). I guess the bond vigilantes are still around. We'll see in the new year whether Bernanke can manipulate the rates down again. If not, watch the American housing market lose another 10% in 2011.

While we're at it, let's take a peek at a 6-year chart of American national average gasoline prices (regular unleaded), from gasbuddy.com.

Gasoline prices are back in the same range they were at near the highs during 2005, 2006, and 2007 when Bernanke was unaware that house prices could fall on a national basis. Forget 2008 because that was the speculative blow-off in commodities, and (in my opinion) is unlikely to happen again for several years.

After all the above bafflegab, here's my thesis. We're at the point where commodity prices cripple the economy. I use oil as my indicator, and more precisely the 50 dma of oil prices. Oil price feeds into the cost of almost every undertaking. The money Bernanke is injecting is going mostly into stocks, commodities and emerging markets.

There is an undeclared economic war going on between America and China. Inflation is high in China due to "hot" American money flowing in, and the Chinese are some PO'd. This is an attempt to get China to increase the value of the Yuan, so Bernanke can continue taking the US dollar down. But as the US dollar decreases in value, things priced in USD go up (like oil) which is a tax on the lower economic classes in America. But the Banksters make out like the bandits they are. It's all part of the plan to accelerate the transfer of wealth from the working class, and what's left of the middle class, to the wealthiest members of society.

Don't listen to stated intentions. Look at what actually transpires (and has transpired) as governments and Banksters manipulate currencies, markets, and laws.

Be aware that most economists and Wall Street analysts think that it takes about $110-120/bbl oil price to drop the US GDP to zero. Really? Maybe that's why many of them are predicting $150 to $200 oil price in 2011, and gasoline up to $5.

That is extremely unlikely, and if it does happen it will be for a very short period. If the O'Bomber stimulus and the Bernanke "quantitative easing" were stopped tomorrow, next week we would see a crash in stock markets and commodities. At least 10% of US Federal government spending is borrowed money, adding to the debt. Take that away, and the economy is instantaneously in deep recession.

Europe is in worse shape economically than the US, and China is hard to read. I expect China to exhibit major social and economic problems in 2011 as their bank debt and huge housing bubble finally cannot be expanded more. If China doesn't crash first, they will continue driving up the price of commodities until Europe or the US (probably Europe) take a dirt dive. In the end it doesn't matter who is first. Those three major economies are linked like Siamese triplets, so damage to one tends to inflict pain on the other two.

The minimum wage in Bejing is rising 21% next week. Bejing is also severely cutting back on the number of permits for new cars in 2011, due to traffic jams and lack of parking space. Duh! Who woulda thunk? Maybe they could have looked at some North American cities traffic problems before re-creating the same thing. It just shows people don't learn from others' mistakes; another example is financially over-extended Canadians who learned nothing from their American friends and relatives. It's always "different here".

China is producing about 17 million vehicles this year and most of them are for new users. Every new user adds to fuel consumption, as well as the materials used in automobile manufacturing. In North America, most new vehicle sales are at about the same rate that older vehicles are being scrapped, so there are not many new users, and there is some salvage from scrapped vehicles. And the newer vehicles are usually more fuel efficient than the older ones, so it is possible for there to be a reduction in fuel consumption.

That is not possible in China. Vehicle sales and fuel consumption continue to rise. The same applies to all developing countries. At some point their demand drives energy and other commodity prices to a point where growth in developed nations ceases (because our economies are much more dependent on low energy costs, due to our huge per capita energy consumption). I'm thinking we're already there.

That is not possible in China. Vehicle sales and fuel consumption continue to rise. The same applies to all developing countries. At some point their demand drives energy and other commodity prices to a point where growth in developed nations ceases (because our economies are much more dependent on low energy costs, due to our huge per capita energy consumption). I'm thinking we're already there.

The bright spot on the energy scene is natural gas prices. At $4 this is a bonus for consumers. It is also a bonus for the Canadian bitumen producers, since their operations are basically an arbitrage on natural gas and oil prices. This article states the Fort McMoney boys use 20% of Canadian natural gas consumption.

This price is too low for gas producers to make money. It is a result of companies staking out positions in shale gas plays, and then having to do a certain amount of drilling and production to hold their land positions. They know they are over-producing but it's basically a war to see who survives and who goes under. In 2009 there was a big enough contango in natural gas futures prices (higher prices for longer dated futures) that many companies could hedge some of their 2010 delivery prices. For instance, Encana hedged something like half of its 2010 production at prices around $6. That's still not good, but better than the $4 they're getting for the other half.

The chart below shows the futures strip price for natural gas for the next two years. A producer could lock in delivery price for next December for $5.02 and for December 2012 for $5.42. That's a real gamble because it's not much above current prices, and if spot market prices are higher then, they will have hedged below market prices. If there is no price spike this winter there will be no opportunity for producers to hedge some future production at significantly higher costs. 2011 will likely be the year that many under-capitalized producers go out of business. Chart is from metalprices.com.

Conclusion

I think we are near the end of this current rise in energy prices, and many other commodities as well. In my previous post I indicated that I thought prices would stay between $60-90 with only brief spikes outside that range. For the next six months I'm raising that range to $65-95.

If there is an oil supply scare (due to real or imagined issues) there could be another price spike like in 2008, but I would expect the spike to be lower, and of shorter duration. The entire consumer psychology has changed and people will change their habits by cutting consumption quickly. They have no choice; they no longer have credit available. The mutterings are already beginning about $3 gasoline, and the usual conspiracy theories about price rises are being dusted off and plopped into reader comments on the blogs.

Bernanke & O'Bomber may provide enough liquidity to get oil prices past $100, but I think this will be self defeating and self correcting. It is not their purpose to do so, but the commodity vigilantes will not let them depreciate the dollar and/or increase the money supply without driving up commodity prices of all kinds, especially oil. I expect the American economy to re-enter recession in the second quarter of 2011 (although many knowledgeable people whose opinions I respect disagree), and Canada will follow by the end of 2011. You can't cure a debt crisis with more debt.

Our North American lifestyle is dependent on cheap and plentiful energy. Watch the price of oil, as it is the most important energy source. The higher oil price goes, the sooner we approach the next economic downturn.